Ravencoin — Flying the Nest - WRITTEN BY Tron Black

There comes a time in every young Raven fledgling’s life when it is time to fly the nest and become more independent. That time has arrived for Ravencoin.

Ravencoin needs to be independent from the Medici Ventures’ nest. Thankfully, Medici Ventures is ready to help in this transition by providing the wings for Ravencoin to leave our nest and ensure our new home is safe, independent and long lasting.

The Ravencoin Foundation (Why)

In order to be independent financially, and in decision making, Ravencoin needs a foundation. A foundation can help provide many of the things that have been requested by the Ravencoin community::

A Ravencoin-friendly independent governance structure.

A place where projects that benefit Ravencoin can be funded and launched.

A location where anyone can get information about the project — and find tooling, and 2nd layer systems.

A legal entity that can run some fall-back seed nodes, explorer, and Ravencoin monitoring systems.

A way to pay developers, and pay bug bounties to keep the Ravencoin network secure.

A plan and funding for hackathons, talks, panels, sponsored events, and more to help extend the Ravencoin asset ecosystem.

The Ravencoin Foundation (Decentralization)

Decentralization and independence is easy when only the code is considered. Anyone is free to run the code and associated binaries, or not. By running the code, the miners, pools, users, HODLers, exchanges, gateways, or custodians, are adopting the consensus rules encoded into that source code. Anyone is free to change the consensus rules and run their own version of the rules, but when there is a conflict, they are relegated to their own chain from that point forward.

Once there’s a foundation there to assist in the other areas of the ecosystem, it’s critical that the governance of the foundation isn’t dominated by one interest, such as HODLers, at the expense of projects building on top of the Ravencoin platform. For this reason, the foundation’s governance should include board representatives from seven different roles in an attempt to distribute power among different types of stakeholders in the Ravencoin ecosystem. As much as possible, but within the limits of state laws, these board positions should be chosen by the network participants.

The foundation, which is designed to be independent, represent the Ravencoin ecosystem varied interests, and be internally decentralized can push the envelope in decentralized governance, and may become the reference standard for future blockchain projects.

It should be said that this is not being done because Medici was exerting undue influence over the project. Ravencoin has been able to build, grow, and flourish with Medici’s support for developers, but it has hit some limits on where it can go without some additional funds to support future development and the expand the ecosystem. Some of the top crypto-projects are able to hold workshops, run hackathons, increase development, provide technical assistance to projects, fund 2nd tier tools, and generally get the word out about benefits. Ravencoin needs to do the same to be a top ten project.

The Ravencoin Foundation (Governance)

It took a while to figure out how to make a board truly independent, and also representative of all the roles in the ecosystem extending from the amazing new capabilities of Ravencoin. This is not the first iteration, and it may not be the last, but this is latest iteration of the Ravencoin Foundation governance structure which could be encoded into the bylaws of a Wyoming non-profit.

Membership (by Role) — Board Directors

Hodler Representative (Board Director)

Voted by signing name of new board member with private keys associated with holding address.

Development board director, Legal board director, and Marketing board director determine the vote block number.

Specific block number used at the point where this board member needs to be filled to eliminate possibility of vote tampering by shifting RVN.

Tie goes to Legal board director.

Mining Representative (Board Director)

Vote for a representative via Blocks mined

One letter represents each person. A=Alice, B=Bob, C=Charlie, etc. Character goes in mined block as part of the version bits (4 bit encoding).

Vote cycle of 2016 blocks determines new board member.

Vote cycle determined by when this board director leaves, and other 6 board members determine block cycle where (blockheight % 2016) = 0. Block cycle happens every 1.4 days.

Tie goes to Development board director.

Development (Core) and 2nd Layer Representative (Board Director)

One of the core developers representing technical interests

Selected by other 6 board members.

Tie goes to Hodler representative.

Project Representative — Built on top of Ravencoin (Board Director)

Any Member can nominate a board director.

Projects pay yearly dues to be in foundation and become eligible to vote.

Tiered — with increase voting rights for higher tiers.

$1,000,000 — Platinum with 1600 votes

$100,000 — Gold — 140 votes

$10,000 — Silver — 12 votes

$1,000 — Bronze — 1 vote

Vote tokens RVN_PROJECT/2020, RVN_PROJECT/2021 for membership dues

Vote the tokens for board member.

Tie (or zero projects sponsoring) goes to 6 board director vote with Miner representative breaking 3/3 tie.

Legal and Finance Representative (Board Director)

Doug, Stanton, Erik V., etc. Must be filled by Ravencoin-friendly attorney

Selected by other 6 board members — Tie goes to Hodler representative

Marketing (Social Media/promotion) Representative (Board Director)

Voted by 6 other board directors.

Tie goes to Project board director.

Security Tokens Representative (Board Director)

Each project that has a vote token can nominate a board director.

One vote per project that tokenized any asset/company over $10,000

Projects will be given a token for the year that the STO issues to the public. Example: RVN_STO_PROJECT/2020

Tie goes to Marketing board director.

An outgoing board member may suggest a replacement, and if he/she is leaving voluntarily and in good standing may also be included in the vote for his/her replacement.

No board director will be forced to hold a board director position even if voted in and an individual may not hold two board director slots.

Additional rules would be established for how the seven board member votes can direct spending to further the Ravencoin ecosystem.

The Ravencoin Ecosystem

Ravencoin core code

Ravencoin mobile wallets

Ravencoin mining software

Ravencoin community efforts

Ravencoin mining pools

Ravencoin miners

Ravencoin 2nd layer tools

Ravencoin explorers

Ravencoin asset explorers

Ravencoin exchanges

Ravencoin third-party developers

Ravencoin test suites

Ravencoin APIs

Ravencoin foundation website(s)

Ravencoin third-party website(s)

Ravencoin hardware wallets

Ravencoin wallets

Ravencoin projects

Ravencoin eduction sites

Ravencoin awareness initiatives

Ravencoin supporting podcasters

Ravencoin supporting influencers

Ravencoin social media accounts

Ravencoin security audits

Ravencoin core — signing keys

Ravencoin mobile — signing keys

Ravencoin bug bounty fund

Ravencoin development fund

Ravencoin merchants

Ravencoin asset issuers

Ravencoin HODLers

Ravencoin network seed nodes

Ravencoin monitoring systems

Bootstrapping the Board

The board votes will create a self-sustaining board, but the board needs to be created initially.

Steps (in order):

HOLDer Board Director vote

Mining Board Director vote

Development Board Director vote (tie to HOLDer BD)

Project Board Director vote (if sponsors) (tie to Mining BD)

Legal and Finance Board Director vote (tie to HODLer BD)

Marketing Representative vote (tie to Project BD)

Security Token Representative vote (tie to Marketing BD)

By following this order, the board can be established with existing rules, influenced heavily by voted interests. Votes from existing Board Directors may not reach 6 or an odd number, but tie breaking rules are consistent with ongoing self-sustaining rules.

The Ravencoin Foundation (Wyoming)

Why Wyoming? To some, this may be just a so-called fly-over state. But, this is the obvious choice for a crypto project today.

“Wyoming has emerged as one of the most crypto-friendly jurisdictions in the United States and has enacted more than a dozen bespoke pieces of legislation aimed at attracting blockchain and cryptocurrency businesses to the State.” — according to Carlton Fields.

The work of Caitlin Long and Tyler Lindholm has put Wyoming on the leading edge of crypto-friendly state legislation.

The Ravencoin Foundation (Funding)

So how does Ravencoin move forward in the foundation without Medici’s financial backing?

Ravencoin had a few setbacks recently, but those have been addressed, and it’s time to move back up the crypto-rankings. The great news is that Ravencoin is a very successful project by almost every measure.

A post-mine would allow Ravencoin itself to fund a foundation at a level that would make it self-sufficient, and also let it thrive and compete with other tokens. Wait? What? What is a post-mine? It is a way for a project to be self-funded. It is VERY different from a pre-mine. A pre-mine is where the founders benefit by getting a bunch of tokens for free that they can later dump, and that puts the project at risk and benefits only a few. Ravencoin did not have a pre-mine. A post-mine, by contrast, is only possible after a coin, like Ravencoin, is well established, and has a market value, and if done properly will benefit the entire Ravencoin ecosystem.

At this point, none of this is written in stone. In fact, none of this is written at all. The code has not been changed. This is just the best way forward for Ravencoin that I can see, given the constraints that currently exist. If there are generous corporate donors that would like to support Ravencoin development at a level that keeps it safe and secure, that would be an attractive option, but I don’t see that materializing.

Post-Mine (Transition)

A post-mine would not change the total number of RVN. It would allocate a percentage of the block reward in RVN and apportion it to the Ravencoin Foundation address where it would be used only for the benefit of the Ravencoin ecosystem.

So where do the funds come from? The answer is the block reward which ordinarily goes to the miners. But not all of the block reward, only 6%. So then the miners, who get to decide which software they run need to make a choice. Is it better to get 100% of a shrinking pie, or is it better to get 94% of a much larger pie, or two pies, or 10 pies?

Why 6%? Because this would allow Ravencoin to have a strong and well funded foundation that could really do a lot to benefit the Ravencoin ecosystem and very likely increase the value of RVN. A foundation can be created and run with less, but one of the goals of this transition is to have the Ravencoin asset platform thrive, not just limp along.

The Miner’s Choice

The miners decide which software to run, so they could choose not to run the new software. But that means that Ravencoin doesn’t have development funds to continue. The software will continue to work as-is, that’s just what it does, but there won’t be a dedicated team improving it, fixing bugs, and monitoring the network for threats.

Or the miner’s can run the software that helps fund the foundation, and reap the rewards of the renewed interest, better governance, increased funding for development, bug bounties, improved security, increased marketing, support for new projects, better monitoring, Ravencoin hackathons, talks, panels, trade shows, sponsored events, press releases, etc.

It’s in the miner’s best interest to have a thriving Ravencoin network with developers, monitoring, bug bounties, better security, with a foundation that can educate, and help projects build on the platform. For that reason, it is very likely that the miners will voluntarily adopt the new software which will fund the foundation.

So how do the miners know that the funds will go to the right things? That’s why the composition of the foundation board directors is so critical. The board of directors represent all the different aspects of Ravencoin, so each interest is represented, and each has a voice. HODLers have a voice, core development has a voice, and even legal and financial has a voice to keep the whole project safe and solvent. Projects built on Ravencoin, and even those issuing STOs on Ravencoin have a representative voice. And, of course, there’s a board director representing the miner’s interest. The miners and mining pools get to vote for their Foundation board director.

Alternative Choices (Analysis)

Other options were considered, and other projects were analyzed to see how they are funded.

Many did a pre-mine, or ICO, like EOS, Ripple, TRON (no relation), Tezos, and Ethereum so there was a pre-funded treasury that could be used to support the project. These projects, most of which violated SEC rules, have either paid fines, or squeaked past an invisible and somewhat arbitrary decentralization line or both. Ravencoin did not sell any tokens, so this was never an option.

Other projects that were very early like Litecoin, and Bitcoin were able to become large enough to attract funding, or are partially funded by a few influential corporate interests. This has led to some fights over the direction of the project, and caused some forks. The early, and very successful project Litecoin has experienced some foundation funding challenges.

Forks like Bitcoin SV, or Bitcoin Cash are mostly funded by their influential respective leaders Craig Wright, and Roger Ver which received funds from both Bitcoin and through the fork, from their own projects.

Some projects, like Cardano, have been funded from the proceeds of Ethereum’s success.

Some have suggested that corporate sponsors, or independent developers generously donating their time could be the answer. Both of those are still possible and have been factored into the foundation governance model, but after almost three years of soliciting additional volunteer developers, there have been a few altruistic and generous souls, but not enough to keep Ravencoin safe, secure, and growing.

The NEM foundation had some challenges including losing a signatory on their funds, and some infighting. This seems to be a result of poor financial governance resulting in overspending in flush times and taking on excessive debt.

The idea of funding the development directly from the network is not new, or unique. Dash, for example, has ample development and marketing resources which are funded directly from the network itself. While Dash uses a masternode voting system where certain nodes that hold 1000 DASH ($71,000 worth at the time of this writing) are able to vote and direct network funds. Ravencoin, by contrast, would be pioneering a hybrid model that has a decentralized human board of directors who are invested in the success of the Ravencoin project because they’re chosen by the Ravencoin community and stakeholders of the Ravencoin ecosystem.

Governance of the Future

To my knowledge, this has never been done before. It is a bit like the US Constitution* for the Ravencoin ecosystem. There’s a separation of powers, and a check-and-balance built into the governance structure. No one interest dominates, and all board directors work together for the benefit of Ravencoin and the platform.

*Yes — I know the US Constitution has some current challenges, but it had a good run — 230+ years.

Summary

The Medici Ventures nest was comfortable, and worked well for the first three years, but it’s healthier for the Ravencoin asset platform to be independent and self-sufficient. This transition to independence will help take Ravencoin to the next phase and also provide additional funding to allow it to reach its full potential.

The choice is not mine. It’s ours. Medici will help create the foundation. Together, we provide the governance. And if the miners make the smart choice, the network will provide the funding, and Ravencoin goes to the next level.

KAAAWWW!!!

WRITTEN BY Tron Black

엠블 랩스 우경식 대표,수수료 없는 “구름대리” 정식 출시…첫 이용시 만원 할인

엠블 랩스 우경식 대표,수수료 없는 “구름대리” 정식 출시…첫 이용시 만원 할인 블록스택, 스테이크드와 협업...STX 보유하면 비트코인 받는다

블록스택, 스테이크드와 협업...STX 보유하면 비트코인 받는다 가상자산 시범거래소 '디비엑스'(DBX) 오는 12월 1일 출범

가상자산 시범거래소 '디비엑스'(DBX) 오는 12월 1일 출범 토카막 네트워크, 디파이 프로젝트 미터와 파트너십…이더리움 기능 및 확장하기 위한 공동 기술 개발 나서

토카막 네트워크, 디파이 프로젝트 미터와 파트너십…이더리움 기능 및 확장하기 위한 공동 기술 개발 나서 블록체인 기반 포인트 통합 플랫폼 밀크파트너스, 새로운 이용자 혜택 더한 ‘밀크팩 시즌4’ 연다

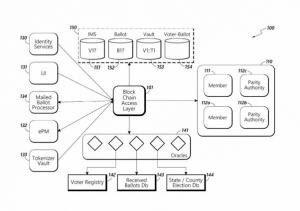

블록체인 기반 포인트 통합 플랫폼 밀크파트너스, 새로운 이용자 혜택 더한 ‘밀크팩 시즌4’ 연다 블로코, ‘특허 청구항으로 알아보는 미 우정국(United States Postal Service, USPS)의 블록체인 투표’ 보고서 발표

블로코, ‘특허 청구항으로 알아보는 미 우정국(United States Postal Service, USPS)의 블록체인 투표’ 보고서 발표